Research

African-American banks

Banking on African-American Business

With a new data set of banks owned and managed by African Americans from 1907 to 1930, I provide the first analysis of the contribution of African-American banks to the development of African-American communities. Economic progress is measured by business ownership, proxied by the number of African-Americans who reported employing at least one person, as well as white-collar occupations, mortgages, and home ownership. Fixed effects analysis shows that an additional African-American bank per ten thousand African-American adults in a county increased the share of African-Americans employing at least one person by 1.9 percentage points, one-and-a-half times the median rate. The effects on white-collar occupations and home ownership are positive but relatively small. Many of the effects are concentrated in the South. Overall, African-American banks made significant contributions to their communities, contrary to skepticism evinced in previous literature.

Triple Segregation: Virginia African American Banks, 1915-28

A new dataset of declassified Virginia bank examinations from 1915 to 1928 shows that banks owned and operated by African-Americans generated lower profits than white banks. This chapter shows that these lower profits were likely due to African-American banks facing three segregated markets: the markets for borrowers, for bank deposits, and for mergers were all significantly different. In each case, the customers for African-American banks were almost entirely African-American. This confirms the assertions of scholars that the most important difference for the performance of African-American firms was the exclusion of white customers from their market. These segregated markets, along with other factors, may have led African-American banks to pursue lower-risk strategies in their asset allocation and deposit mix.

Publication

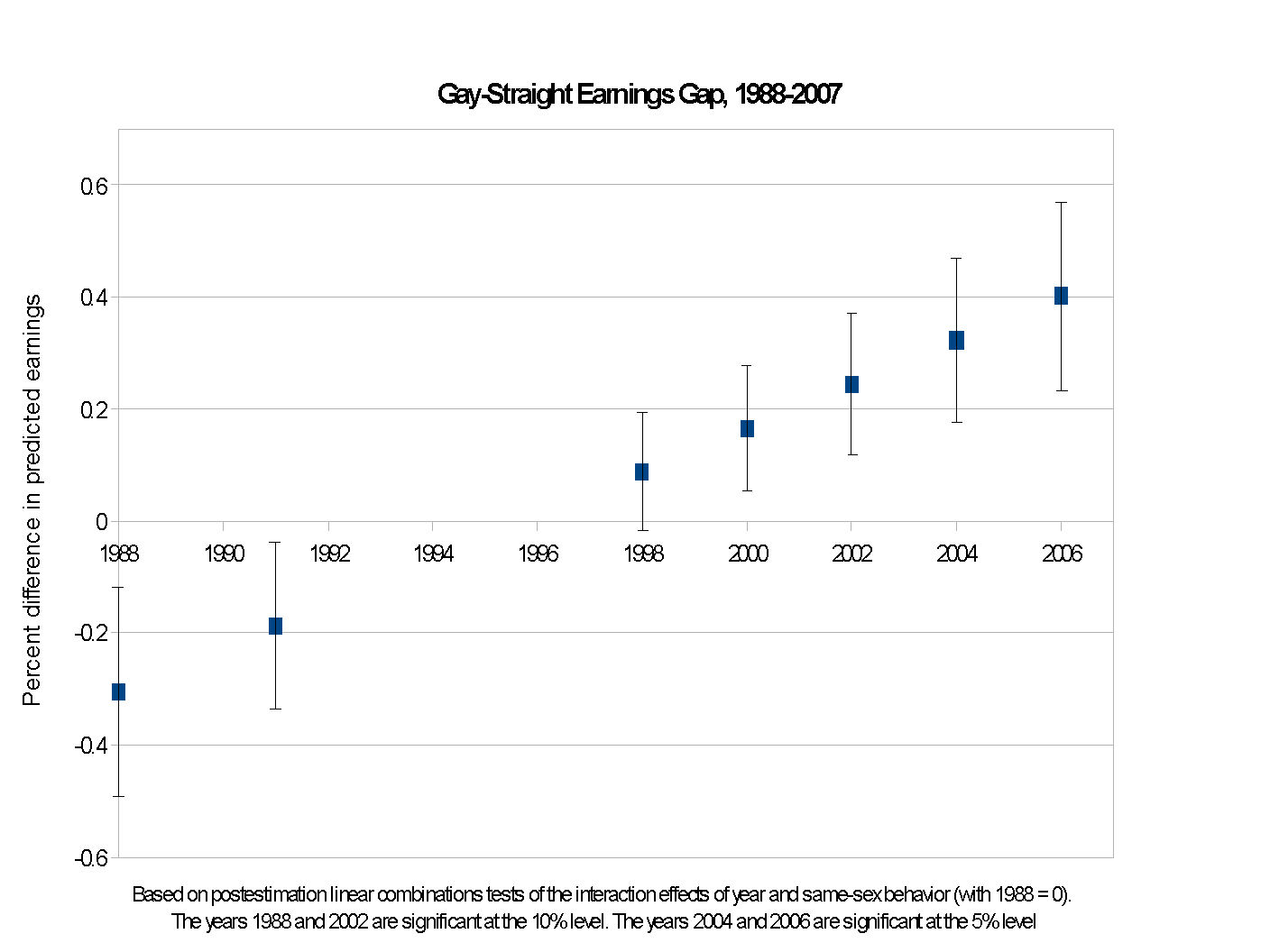

The Disappearing Gay Income Penalty

Economics Letters, 2013 (with Purvi Sevak)

Since 1995, labor economists have reported on the income disparities between individuals who engage in same-sex behavior and those that do not. Many of these papers report a significant wage penalty, while others find no effect, but few look at the trend over time. We find, using National Health and Examination Survey (NHANES) data from 1988 to 2007, that the income gap has reversed over time from a penalty to a premium.

Other research projects

Newfoundland’s Two Transitions

This survey uses primary and secondary historical sources to summarize the extraordinary events in Newfoundland in the early twentieth century, as the self-governing dominion becomes the only nation to vote to end representative government, and later joins the Canadian federation.

photo source: http://www.heritage.nf.ca/law/assembly.html

Over-Investment and Over-Agreement in the Shadow of Conflict (with Barry Sopher)

This paper reports the results of a bargaining model that provides agents with a choice between production and protection in a setting with a winner-take-all disagreement point, and then examines this model by conducting a laboratory experiment. Using different endowments and different contest success functions, we find that, while the risk-neutral mutual best response predicts agent behavior well, most agents over-invest in preparing for disagreement. Additionally, we find that many agents compromise rather than engage in conflict, even when it is more profitable to do so. In the experiment, subjects agree approximately 40% of the time, much higher than the predicted rate of 0%.